By Aniket Dani

Insolvency and Bankruptcy Code2016 (IBC) has accelerated recovery and changed the way non-performing assets (NPAs) are handled by banks in India. By prioritizing resolution over liquidation, this has led banks to shift from protracted legal battles to a proactive, pragmatic and lender-led approach that maximizes the value of distressed assets.

However, if the time-bound process is implemented more strictly, the recovery rate under the regime can increase significantly. Continued reforms are needed to reduce processing delays, excessive court burden and creditor reluctance, and to ensure resolutions are in line with global standards.

How IBC has helped improve solutions

As of March 2024, the gross NPA (GNPA) ratio of banks stood at Rs 4.8 trillion, or 2.80% of outstanding loans – a historic low.

This marks a sharp decline of ~54% from the ratio’s peak of 11.6% in FY2018 to Rs 10.4 trillion. During this period, under the IBC, NPAs relating to over 900 companies were resolved, leading to recovery of Rs 3.4 trillion (about 60% of the decline in GNPAs).

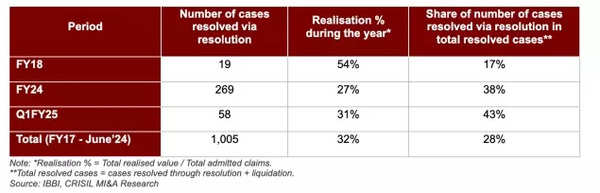

As of June 2024, the average recovery rate through resolution was 32% (since inception) and 6.3% through liquidation. Notably, in cases of recovery through resolution, the total amount received was 1.61 times higher than the total liquidation value of recovered assets, underscoring the fact that resolution provides a more efficient outcome and can be maximized for future cases. Should be done.

According to the data, the number of cases resolved through the resolution scheme increased from 17% in FY 2018 to 38% in FY 2024. Furthermore, timely recovery is directly related to the percentage of recovery, i.e., prompt resolution, leading to higher recovery percentage (covered in the following section).

Number of cases disposed

In FY2024, the manufacturing and real estate sectors achieved the largest share in approved resolution plans, a trend that continued in Q1FY25 with a combined 74% share. With healthy growth prospects in these sectors, lender interest is likely to remain strong.

Many cases have still not been resolved on time

Data indicates that resolutions completed within 330 days resulted in a 49% recovery rate under the IBC, while resolutions completed between 330-600 days resulted in a 36% recovery rate. In contrast, solutions that stretched for more than 600 days resulted in recovery rates significantly lower than 26%.

Despite the 180+90 day deadline, legal challenges, adjournments, promoter objections and huge number of cases in the National Company Law Tribunal (NCLT) have pushed the deadline. Moreover, the absence of a unified arbitration platform for promoters and lenders has further slowed down the process.

As of June 2024, 68% is operational corporate insolvency resolution processes (CIRP) are older than 270 days, with an average resolution time of 685 days (closure through resolution) and 499 days (closure through liquidation), which is much higher than the permitted maximum of 330 days. Delay in resolution may lead to decline in the value of the asset, leading to lower recovery rates for creditors.

It is urgent to strengthen the code

The long timelines in resolving cases, along with lack of capacity to deal with liquidations and the challenges faced by insolvency professionals and valuers in complex cases, also slow down the process. Furthermore, the absence of a clear framework to deal with cross-border insolvency and unique sector-specific challenges, such as regulatory complexities in the real estate, power and infrastructure sectors, adds to the complexity.

To address these challenges, an integrated technology platform has been proposed to ensure consistency, transparency and timely processing. At present, NCLT has 15 benches. To expedite the process, the Finance Minister has proposed reforms in the NCLT, including setting up of new tribunals focused on cases under the Companies Act, 2013, appointment of additional members and setting up of pre-trial tribunals for ‘Micro, Small and Medium Enterprises’. -Includes offering packaged insolvency solutions. and exploring ways to encourage out-of-court settlements to reduce haircuts and lengthy proceedings.

The government has made six amendments to the IBC since its inception and 12 amendments to the rules and model bylaws, resulting in about 86 changes in the regulatory framework.

More needed to meet global standards

Despite significant reforms, the IBC lags behind global peers in speed, recovery rates and judicial efficiency. Unlike the IBC’s average timeline of over 600 days, countries like the UK, US and Singapore usually resolve cases within a year. Recovery rates through resolutions under IBC average 30-40%, while in the US recovery for first lien loans ranges between 60-70%, second lien loans 40-45% and unsecured fund loans 30-40%. Under Chapter 11 and the UK’s high recovery.

Developed economies have more predictable and flexible legal frameworks, allowing faster restructuring without out-of-court settlements and lengthy court battles.

Since the introduction of the IBC, India has improved its Ease of Doing Business ranking (based on the World Bank Report 2020), especially in ‘Bankruptcy Resolution’, from 136 in 2016 to 52 in 2020. However, developed countries consistently rank higher due to their established status. Framework and robust recovery mechanisms.

To become more competitive, IBC needs continuous improvement and adaptation. By addressing challenges such as processing delays, overburdened courts and creditors’ reluctance to take haircuts, India can bridge the gap with mature structures like advanced economies.

Aniket Dani is Director-Research at CRISIL Market Intelligence & Analytics.